Working for Families Tax Credits

Working for Families Eligible Criteria:

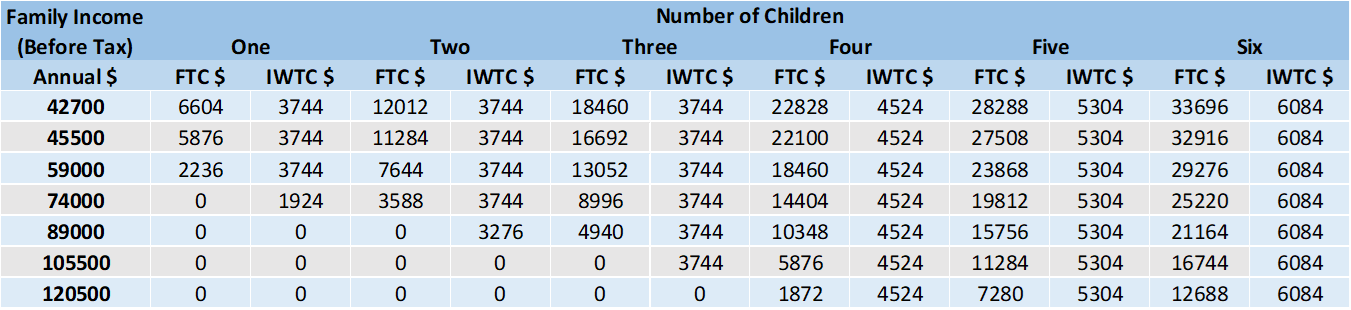

Families Tax Credits and In-Work Payment

Family Tax Credits (FTC) are paid regardless of your source of income. In-work tax credits (IWTC) are for families who normally work a minimum number of hours each week.

- caring for at least one child under 18 who’s financially dependent on you

- over 16

- a New Zealand tax resident living in NZ, or the children in your care are NZ residents who live in NZ.

Families Tax Credits and In-Work Payment

Family Tax Credits (FTC) are paid regardless of your source of income. In-work tax credits (IWTC) are for families who normally work a minimum number of hours each week.

Families Tax Credits and In-Work Payment (1 April 2023 to 31 March 2024)

Families Tax Credits and In-Work Payment (1 April 2022 to 31 March 2023)

Minimum Family Tax Credit

If your annual family income is $34,216 or less after tax, you may be able to get the minimum family tax credit payment. This payment tops up your family's income to at least $658 a week after tax.

To get this payment you must be working or salary wages. A single parent must be working at least 20 hours a week. In a two parent family, one or both parents between them, must be working at least 30 hours a week.

Parental Tax Credit

For children born before 1 July 2018, replaced by Best Start tax credit (details below) commencing 1 July 2018.

This is a payment for up to 10 weeks after a new child arrives in your family. You can receive up to $2,200 depending on your family income.

The amount will depend on:

Best Start Tax Credit

Best Start tax credit is a weekly payment of $69 (up to $3,588 per year) per child for a baby born on or after 1 July 2018. if your baby is due on or after 1 July 2018 but is born earlier than 1 July you are still eligible.

For the first year of the baby's life the family's income is not taken into account. You can still get Best Start until your child turns 3 if you earn under $96,295. Payments will reduce in the second and third year depending on your family income.

Best Start will start paying from 1 July 2018 to customers whose babies are born on or after 1 July 2018.

Notes:

You can't receive the parental tax credit and Best Start payments for the same child.

To be eligible for Best Start:

Extension to Paid Parental Leave

The Parental Leave and Employment Protection Amendment Bill was passed and the duration of paid parental leave will be extended to 26 weeks by 2020.

The new law will increase the duration of parental leave payments over 3 years and 2 stages:

Keeping in touch days will help support workers who may be away from their workplace for a longer period to still maintain contact with their employer and keep abreast of any changes, which will helps the employer to continue to be connected with their employee.

The new law also increases the number of Keeping in Touch days:

If your annual family income is $34,216 or less after tax, you may be able to get the minimum family tax credit payment. This payment tops up your family's income to at least $658 a week after tax.

To get this payment you must be working or salary wages. A single parent must be working at least 20 hours a week. In a two parent family, one or both parents between them, must be working at least 30 hours a week.

Parental Tax Credit

For children born before 1 July 2018, replaced by Best Start tax credit (details below) commencing 1 July 2018.

This is a payment for up to 10 weeks after a new child arrives in your family. You can receive up to $2,200 depending on your family income.

The amount will depend on:

- Family Income (before tax)

- The number of dependent children in your care

- The age of these children, and

- The number of newborn children

Best Start Tax Credit

Best Start tax credit is a weekly payment of $69 (up to $3,588 per year) per child for a baby born on or after 1 July 2018. if your baby is due on or after 1 July 2018 but is born earlier than 1 July you are still eligible.

For the first year of the baby's life the family's income is not taken into account. You can still get Best Start until your child turns 3 if you earn under $96,295. Payments will reduce in the second and third year depending on your family income.

Best Start will start paying from 1 July 2018 to customers whose babies are born on or after 1 July 2018.

Notes:

You can't receive the parental tax credit and Best Start payments for the same child.

To be eligible for Best Start:

- you must be the principal caregiver of the child

- you must be a New Zealand resident or citizen and have been in New Zealand for a continuous period of 12 months at any time

- a New Zealand tax resident

- you must have an IRD number for the child you will get Best Start payments for

- the child you are claiming for is both a resident and present in New Zealand.

Extension to Paid Parental Leave

The Parental Leave and Employment Protection Amendment Bill was passed and the duration of paid parental leave will be extended to 26 weeks by 2020.

The new law will increase the duration of parental leave payments over 3 years and 2 stages:

- an increase from 18 to 22 weeks from 1 July 2018

- a further increase to 26 weeks from 1 July 2020

Keeping in touch days will help support workers who may be away from their workplace for a longer period to still maintain contact with their employer and keep abreast of any changes, which will helps the employer to continue to be connected with their employee.

The new law also increases the number of Keeping in Touch days:

- from 40 to 52 hours from 1 July 2018

- to 64 hours from 1 July 2020